28 November 2024

Shipyard Output Reaches a New 7-Year High

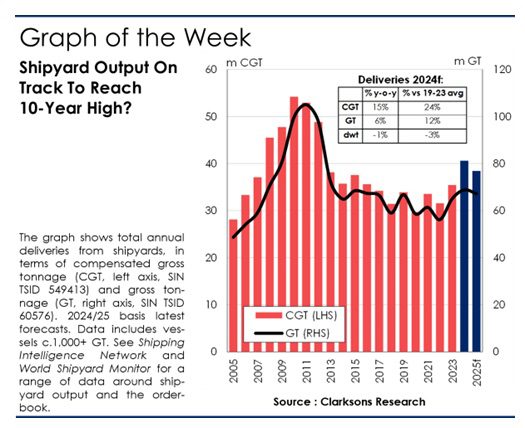

After a 10-year fall, the shipyard output started to pick up in Q1 reaching a 7-year quarterly high. Projecting a 15% y-o-y increase for 2024.

Table of Contents

Concept

After a decade of declining production, shipyard output has begun to edge up in recent years with deliveries in Q1 reaching a seven-year quarterly high (10.1m CGT). The projection for the full year 2024 suggests a 15% y-o-y increase to ~40.6m CGT, although, with a near-term product mix dominated by gas carriers and containerships, the outlook varies by tonnage unit.

What is CGT?

Compensated Gross Tonnage (CGT) was introduced by the OECD in 2007 as a unit of measurement that would objectively reflect the relative shipyard output capacity in different regions of the world. The CGT value is calculated for specific types of ships, not for all floating objects.

Ships of similar volume (that is to say, of similar dimensions) will have a very similar Gross Tonnage (GT) value. However, the utilization of the ship’s available volume resulting from the ship’s type may differ significantly. The more complex unit will have a higher CGT value than the less complex unit.

Mind The Unit

After a 45% decline in shipbuilding output between 2010 and 2020 (basis compensated gross tonnes – CGT – a widely used (but not perfect…) measure of shipyard “work”), deliveries have now begun to edge up in recent years. Shipyard output in 2023 totalled 35.4m CGT, up 12% y-o-y, and it is projected to increase to a ten-year high of 40.6m CGT this year before a marginal decline in 2025. And while shipyard output in gross tonnes (GT) shows similar trends, this year’s shipyard output by deadweight (dwt) is relatively flat (and in fact lower than 2019), reflecting more limited near-term deliveries of typically higher-dwt, lower-CGT bulkers/tankers.

Product Mix

Reflecting the investment cycles of recent years, record containership deliveries are the largest driver of higher output today (2024f: 13.6m CGT, more than double the 2016-22 container average of 5m CGT). LNG deliveries are also projected to double in 2024, to a record 6m CGT and there will also be increases in Car Carriers (+0.9m CGT), steady output in bulkers and a y-o-y decline in tankers. Although it is expected to have some pivoting towards tanker deliveries in the second half of the decade, containerships and gas carriers now account for 50% of all tonnage on order (vs 23% in 2012).

The Problems for South Korea Shipbuilding Industry

South Korean shipbuilders had led the industry but are facing growing challenges and recently slipped back into second place for new orders.

Ship Nerd

Shipyard Output Constraints

With increased pricing (up ~40% since 2020, albeit with significantly increased costs for yards), a strong forward orderbook (3.5 years versus 2.5 years) and good, cross-sector, order demand, and shipyard capacity have been limiting factors in output. We have now begun to see “incremental” capacity increases, principally in China, with some re-activation, expansion and productivity gain. The product mix of individual yards has also evolved: ~20 yards will deliver a containership for the first time in 2023-24, while 4 Chinese yards took their first orders for LNG carriers in 2022.

On The Turn?

Although the long shipbuilding cycle (peaks in 1976 and 2010, troughs in 1986 and 2020) may have reached a “turning point”, there are additional dynamics to consider for the decade ahead. The total number of “active” yards has dropped by two-thirds since 2010, leaving a smaller and more consolidated industry while Chinese yards have reached a 50% market share (South Korea’s share peaked at 35% while Japan touched 50% in the 70s and 80s).

There is little sign of “greenfield” yard development and there is an ageing fleet and a vital green transition driving fleet renewal but with huge uncertainties in regulation and fuel choice. And even with higher shipyard output, deliveries in 2024 will be equivalent to just 4% of fleet capacity compared to 10% in 2010. So after a decade of “pain”, shipyard output is now edging up, with a strong flow of orders and long lead times as yards grapple with questions of future demand, fuel technology, capacity, cycles, competition and costs.

Source: Clarksons

See Also

In 2022, Chinese shipyards reached a market share of 49% and for the first time exceeded the combined market share of Japanese and South Korean shipyards.

While global newbuild order volumes fell (20% y-o-y in CGT terms), 2022 was still an active year for the global shipbuilding industry with higher pricing (up 15% on average), more complex ships ordered (e.g. a record 182 LNG orders of $39bn) and alternative fuel investment increasing (a record 61% of tonnage ordered) all supporting a 6% increase in value of orders to $124.3bn.

Chinese shipyards hit new record 49% market share in 2022

In 2022, Chinese shipyards reached a market share of 49% and for the first time exceeded the combined market share of Japanese and South Korean shipyards.