28 November 2024

Greece leads Russian crude exports with a 33% share

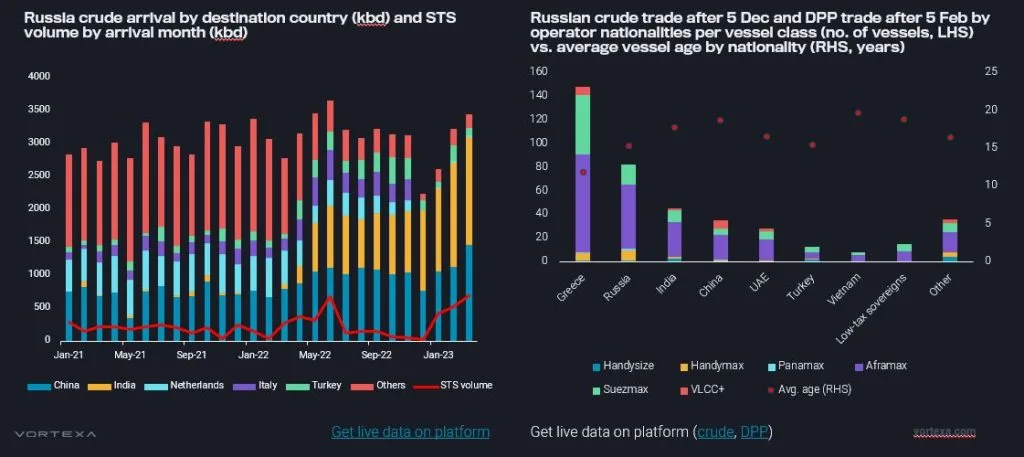

The tanker fleet engaged in the Russian crude trade post-sanctions is predominantly Greek-operated and composed mostly of older Aframax and MR tankers, according to Vortexa.

Concept

The size of the Greek-operated fleet post-European Union ban is nearly 2.5 times bigger than the next fleet, in Russian crude exports.

Nevertheless, the market share Greeks enjoy in this lucrative trade is falling. Vortexa data shows Greek operators had a 40% market share of Russian crude leaving Baltic and Black Sea ports last year, a share that has now fallen to 33% with the rise of Indian and UAE-controlled tanker fleets.

In the clean tanker trades out of Russia, the Greeks are far more dominant. The Greek-operated fleet moving Russian CPP is about four times larger than the next-largest fleet, according to Vortexa.

Ukraine Cracks Down on Greek Owners Trading Russian Oil

Greek owners of tankers have been hit by Ukraine’s efforts to stop the movement of Russian oil. Find out more in this article.

Ship Nerd

Russian Crude Oil Exports

At the macro level, a key question on the minds of market participants is whether the world is short or long on oil. Before OPEC’s announcement of additional voluntary production cuts this month, the data already pointed to a tighter global crude market – as seen from a steady decline in onshore inventories in recent weeks, particularly in the US and China. Further production cuts by OPEC+ members could tighten the market, but the impact could be moderated by a smaller reduction in exports compared to the announced cuts (as we learned from the previous round) and a slowdown in global oil demand.

As Russia’s oil reshuffle continues, some trading patterns are solidifying. India and China have emerged as the top strategic trading partners for Russian crude, accounting each one-third of the total arrivals of Russian oil in March. In considering the alternative markets for Russian oil after the EU ban, we see an interesting distinction of crude, naphtha, and fuel oil exports being concentrated among a handful of destination countries in Asia and the Middle East, whilst diesel supplies have headed towards more diverse markets including Saudi Arabia, Turkey, Brazil, etc.

The dirty and clean tanker fleet supporting the Russian crude trade has also expanded in recent months. Nearly 20% of the global Aframax and Suezmax tanker fleet is now involved in the Russian crude and residual fuel oil trade, and increasingly shifting towards operating exclusively in Russian trade. Similar behavior is seen in the clean tanker segment, particularly in MR tankers, which has consequently reduced the size of the mainstream tanker fleet and added more volatility to freight rates in recent weeks.

Meanwhile, China’s re-opening has boosted domestic crude consumption, which reflected in higher crude imports and slowing product exports, particularly in March. Weak export margins and ongoing refinery maintenance are, however, capping further upsides currently. Faced with growing competition for the Russian ESPO blend and tighter Venezuelan crude supplies, China’s independent refiners are increasing purchases of Iranian crude and condensate, as well as Russian residual fuel oil as supplementary feedstock.

Both clean and dirty tanker rates have firmed in the first quarter of this year, buoyed by higher Chinese crude imports, the reshuffling of Russian crude trade flows, and the knock-on shifts in oil flows to Europe. A potential reduction in OPEC+ crude exports and a slowdown in global oil demand could weigh on tanker rates going forward, with VLCCs facing the highest exposure.

A seasonal uptick in US gasoline demand and higher agricultural diesel demand in Brazil this summer could support MR tanker rates in the Atlantic Basin, whilst a slowdown in clean product exports in Asia would weigh on tanker rates in the region, driving a re-positioning of a portion of the MR fleet from the Pacific towards the Atlantic Basin.

Source: Vortexa

See Also

The IMO Legal Committee, LEG 110, recently discussed the alarming rise of ship-to-ship transfers in the open ocean and the dangers posed by tankers in the “dark fleet.” The practice of ship-to-ship transfers has caused widespread concern for the global liability and compensation regime, as it undermines the regulations outlined in MARPOL.

Dark Fleet Alert – LEG 110 Overview

The IMO Legal Committee LEG 110 discussed the alarming rise of ship-to-ship transfers and the dangers posed by tankers in the “dark fleet.”