28 November 2024

A potential loophole in the EU ETS

QueSeas has published an article focusing on the side effects of the inclusion of shipping in the EU Emissions Trading System (EU ETS).

The enforcement of the EU ETS may give industry stakeholders financial incentives to avoid voyages in the European Economic Area (EEA) and utilize neighboring non-EU countries as intermediate calls. This study investigates the carbon leakage possibility in the crude oil trade of the EU. Exploring three scenarios based on three common crude oil trading routes. Our results show that alternative pathways could lead to revenue loss for the EU ETS and increase the risk of carbon leakage.

Table of Contents

1. Introduction

In 2021, as part of the “Fit for 55” package, the European Commission (EC) proposed the inclusion of the maritime sector under the EU emissions Trading System (ETS). The EU ETS is a Market-Based Measure (MBM) that follows the ‘‘polluter-pays principle’’ and aims to incentivize the ship’s greenhouse gas (GHG) emissions reduction by setting a limit, or cap, on GHG emissions of the shipping sector.

Under the EU ETS, every year a limited amount of EU Allowances (EUAs) will be supplied for the shipping industry which decreases annually to align with the European Union’s goal of cutting greenhouse gas (GHG) emissions by 55% by 2030 compared to 1990 levels and achieving net-zero emissions by 2050. Companies can purchase EUAs to cover their GHG emissions. Each EUA grants the permission to emit one tonne of carbon dioxide (CO2), or the equivalent amount of other pollutants such as methane (CH4), and nitrous oxide (N2O).

Cargo diversion and carbon leakage in ports from EU ETS

There is a risk of cargo diversion in view of the EU ETS on shipping which affects the competitiveness of EU ports and all the supply chains related.

Ship Nerd

2. EU ETS in a Nutshell

Starting from January 1, 2024, shipping companies will need to monitor their emissions by following their MRV plan for the scope of the EU ETS Regulation. According to the EU Regulation 2023/957, the existing MRV plans should be amended, verified, and submitted to the responsible administering authority by April 1, 2024, to include the monitoring of methane (CH4) and nitrous oxide (N2O), in addition to the carbon dioxide (CO2) emissions.

By March 31, 2025, companies will be required to report their aggregated monitoring data at the company level and surrender emissions allowances for each tonne of CO2 emitted based on their reported aggregated emissions at a company level by September 30, 2025, and in subsequent years. Surrendering emission allowances will phase in starting from 40% in 2024 to 70% in 2025 and reaching 100% in 2026.

The EU ETS applies to cargo and passenger ships of 5,000 GT and above from 2024 onwards. Offshore ships of 5,000 GT and above will be included from 2027 onwards. Initially, the regulation will focus on carbon dioxide (CO2) emissions, and from 2026 onwards, the scope will expand to include methane (CH4) and nitrous oxide (N2O).

The accounted tonnes of CO2 emitted for the required allowances to be surrendered are based on the voyage type.

- 50% of emissions apply to ships departing from an EU/EEA port and arriving at a non-EU/EEA port.

- 50% of emissions apply to ships arriving at an EU/EEA port from a non-EU/EEA port.

- 100% of emissions apply to ships performing voyages between EU/EEA ports.

- 100% of emissions apply to ships at berth in an EU/EEA port.

To discourage evasive practices, container ships that make stops at transshipment ports located outside of the EU/EEA but within 300 nautical miles of an EU/EEA port must include 50% of the emissions generated during the entire journey to that port in their calculations. However, there is no similar approach for other ship types like crude oil carriers.

3. Are STS transfers considered “ports of call” in the EU Regulation?

According to Article 3 of the EU ETS regulation:

- Ship-to-ship transfers within the port limits of a non-EU/EEA Member state are considered “ports of call”.

- Ship-to-ship transfers outside the port limits of a non-EU/EEA Member state are not considered “ports of call”.

This study aims to explore if there is a possible loophole in the EU ETS regime that may allow compliance cost reduction and carbon leakage and will focus on carbon-di-oxide (CO2) emissions as of the early implementation stages of the EU ETS.

4. Methodology

4.1 Symbols and Equations

The CO2 emissions are calculated based on the following equation (1):

The allowances to be surrendered are calculated based on the following equation (2):

| Symbol | Definition |

| FC voyage | Total tonnes of fuel consumed per voyage |

| FC Day | Tonnes of fuel consumed per day |

| TCO2 | Tonnes of CO2 emitted |

| ETS Cost | Total cost of ETS allowances |

| CP | EU carbon price |

| CF | CO2 Emission factor |

4.2 Vessel Description

For the scope of the current study we selected a modern SOx scrubber-fitted Suezmax tanker sailing on an average speed of 12 knots with an approximate daily consumption of 40 tonnes of HFO in laden condition.

4.3 EU Carbon Permits Price

The prices of permits on the European Union’s carbon market fluctuate, and for the scope of this study, the price of 90 € per tonne of CO2 is used as of the data in July 2023.

5. Case Studies

5.1 Case Study 1

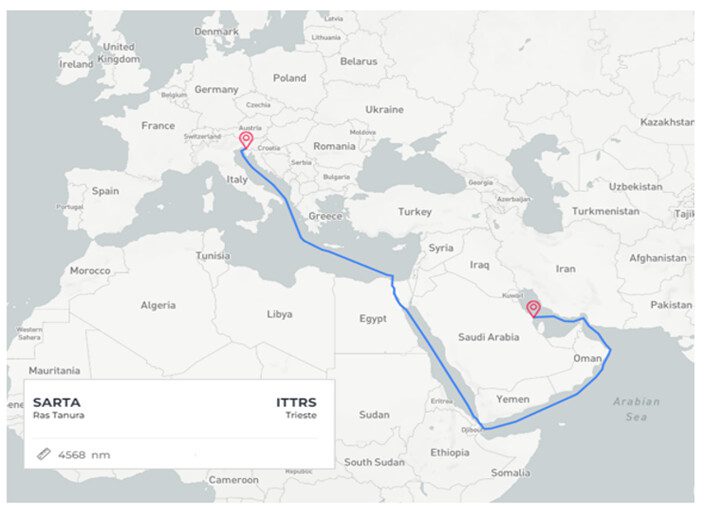

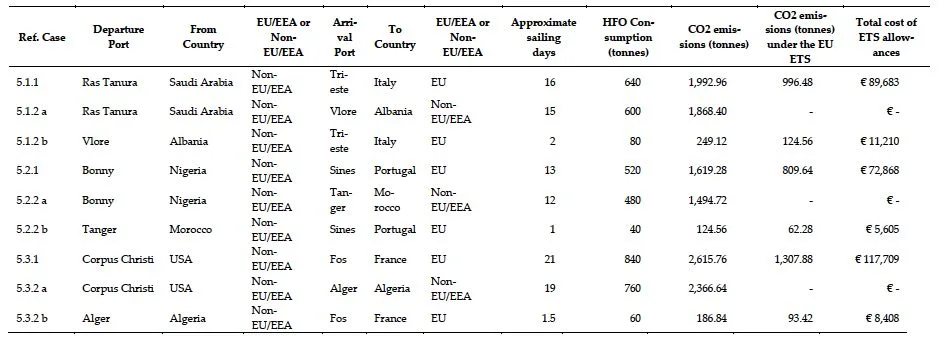

Assuming that the subject Suezmax tanker needs to transport a certain amount of crude oil from Ras Tanura, Saudi Arabia (non-EU/EEA), to Trieste, Italy (EU).

5.1.1 Saudi Arabia to Italy

The voyage from the departing port of Ras Tanura, Saudi Arabia (non-EU/EEA) to the arrival port of Trieste, Italy (EU) sailing on an average speed of 12 knots lasts approximately 16 days. For this voyage, the ship will have approximately 640 tonnes of heavy fuel oil consumed. The CO2 emissions for this amount of fuel oil are equal to 1,992.96 tonnes. Taking into account that 50% of emissions apply to ships arriving at an EU/EEA port from a non-EU/EEA port, the emissions under the EU ETS to be considered are 996.48 tonnes of CO2. Therefore, the overall expenditure increase due to the EU ETS compliance cost for this voyage is equal to 89,683 €.

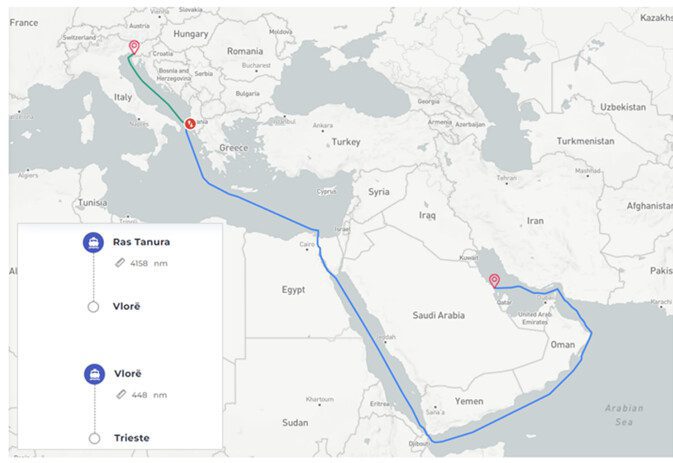

5.1.2 Saudi Arabia to Italy via Albania

An alternative pathway for the crude oil to be transported starting from Ras Ta-nura, Saudi Arabia (non-EU/EEA) and arrive at the final port of destination Trieste, Italy (EU) via an intermediate call to a Floating Storage Offloading (FSO) unit within the port limits of Vlore, Albania (non-EU/EEA). We assume that another Suezmax tanker loads the cargo from the FSO unit and transports the cargo to the final destination of Trieste, Italy (EU).

In this case, the voyage leg breaks into the following two parts:

- Ras Tanura, Saudi Arabia – Vlore, Albania

For this part, none of these two ports are EU/EEA, therefore there is no need to surrender any allowances for the EU ETS scheme. - Vlore, Albania – Trieste, Italy

For this part, the CO2 emissions for this amount of fuel oil (80 tonnes) are equal to 249.12 tonnes. Taking into account that 50% of emissions apply to ships arriving at an EU/EEA port from a non-EU/EEA port, the emissions under the EUETS to be considered are 124.56 tonnes of CO2. Therefore, the overall expenditure increase due to the EU ETS compliance cost for this voyage is equal to 11,210 €.

In the alternative scenario, the EU ETS compliance cost to transport the same amount of cargo between the same departure port and final destination port is reduced by 88% and the allowances to be surrendered are only 11,210 €.

5.2 Case Study 2

Assuming that the subject Suezmax tanker needs to transport a certain amount of crude oil from Bonny, Nigeria (non-EU/EEA) to Sines, Portugal (EU).

5.2.1 Nigeria to Portugal

The voyage from the departing port of Bonny, Nigeria (non-EU/EEA) to the arrival port of Sines, Portugal (EU) sailing on an average speed of 12 knots lasts approximately 13 days. For this voyage, the ship will have approximately 520 tonnes of heavy fuel oil consumed. The CO2 emissions for this amount of fuel oil are equal to 1,619.28 tonnes. Taking into account that 50% of emissions apply to ships arriving at an EU/EEA port from a non-EU/EEA port, the emissions under the EU ETS to be considered are 809.64 tonnes of CO2. Therefore, the overall expenditure increase due to the EU ETS compliance cost for this voyage is equal to 72,868 €.

5.2.2 Nigeria to Portugal via Morocco

An alternative pathway for the crude oil to be transported starting from Bonny, Nigeria (non-EU/EEA) and arrive at the final port of destination Sines, Portugal (EU) via an intermediate call to a Floating Storage Offloading (FSO) unit within the port limits of Tanger, Morocco (non-EU/EEA). We assume that another Suezmax tanker loads the cargo from the FSO unit and transports the cargo to the final destination of Sines, Portugal (EU).

In this case, the voyage leg breaks into the following two parts:

- Bonny, Nigeria – Tanger, Morocco

For this part, none of these two ports are EU/EEA, therefore there is no need to surrender any allowances for the EU ETS scheme. - Tanger, Morocco – Sines, Portugal

For this part, the CO2 emissions for this amount of fuel oil (40 tonnes) are equal to 124.56 tonnes. Taking into account that 50% of emissions apply to ships arriving at an EU/EEA port from a non-EU/EEA port, the emissions under the EUETS to be considered are 62.28 tonnes of CO2. Therefore, the overall expenditure increase due to the EU ETS compliance cost for this voyage is equal to 5,605 €.

In the alternative scenario, the EU ETS compliance cost to transport the same amount of cargo between the same departure port and final destination port is reduced by 92% and the allowances to be surrendered are only 5,605 €.

5.3 Case Study 3

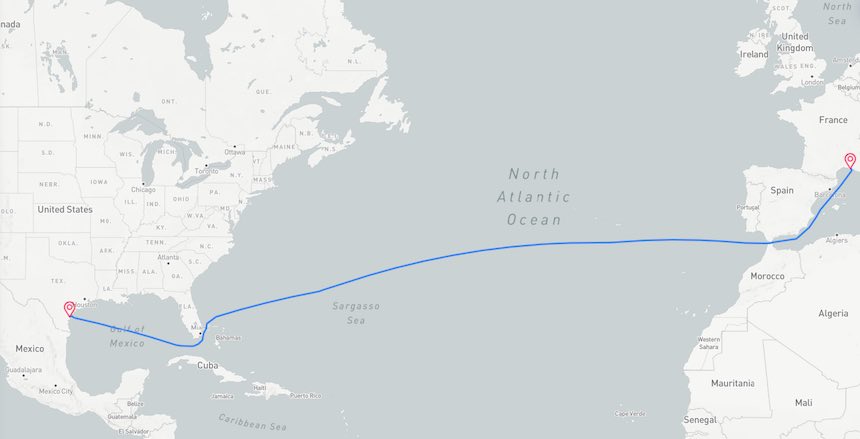

Assuming that the subject Suezmax tanker needs to transport a certain amount of crude oil from Corpus Christi, USA (non-EU/EEA) to Fos, France (EU).

5.3.1 USA to France

The voyage from the departing port of Corpus Christi, USA (non-EU/EEA) to the arrival port of Fos, France (EU) sailing on an average speed of 12 knots lasts approximately 21 days. For this voyage, the ship will have approximately 840 tonnes of heavy fuel oil consumed. The CO2 emissions for this amount of fuel oil are equal to 2,616 tonnes. Taking into account that 50% of emissions apply to ships arriving at an EU/EEA

port from a non-EU/EEA port, the emissions under the EU ETS to be considered are 1,307.88 tonnes of CO2. Therefore, the overall expenditure increase due to the EU ETS compliance cost for this voyage is equal to 117,709 €.

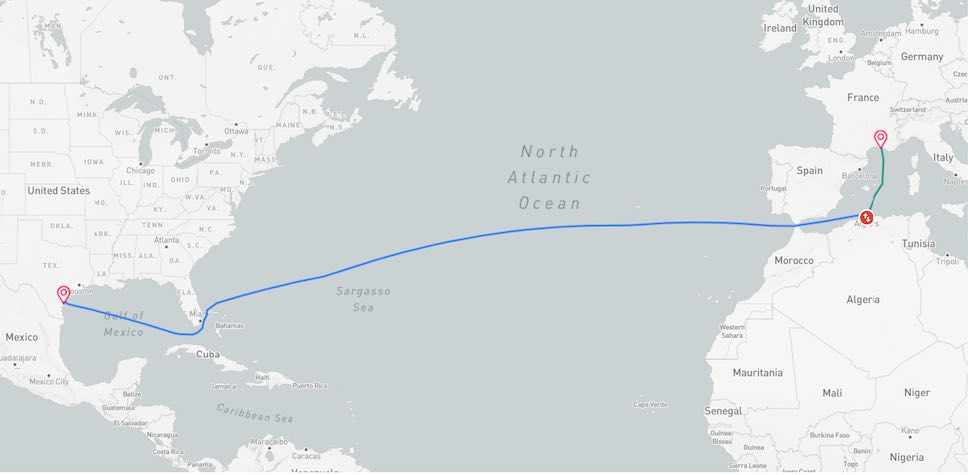

5.3.2 USA to France via Algeria

An alternative pathway for the crude oil to be transported starting from Corpus Christi, USA (non-EU/EEA) and arrive at the final port of destination Fos, France (EU) via an intermediate call to a Floating Storage Offloading (FSO) unit within the port limits of Alger, Algeria (non-EU/EEA). We assume that another Suezmax tanker loads the cargo from the FSO unit and transports the cargo to the final destination of Fos, France (EU).

In this case, the voyage leg breaks into the following two parts:

- Corpus Christi, USA – Alger, Algeria

For this part, none of these two ports are EU/EEA, therefore there is no need to surrender any allowances for the EU ETS scheme. - Alger, Algeria – Fos, France

For this part, the CO2 emissions for this amount of fuel oil (60 tonnes) are equal to 186.84 tonnes. Taking into account that 50% of emissions apply to ships arriving at an EU/EEA port from a non-EU/EEA port, the emissions under the EUETS to be considered are 93.42 tonnes of CO2. Therefore, the overall expenditure increase due to the EU ETS compliance cost for this voyage is equal to 8,408€.

In the alternative scenario, the EU ETS compliance cost to transport the same amount of cargo between the same departure port and final destination port is reduced by 93% and the allowances to be surrendered are only 8,408 €.

6. Conclusions

The conclusion is straightforward.

The EU ETS compliance cost is significantly reduced if intermediate calls in non-EU countries neighboring EU Member states are introduced.

This loophole might be considered a business opportunity for several parties (non-EU countries, ship management companies, oil trading companies) and lead to a change in the oil import/transportation landscape of Europe, revenue loss for the EU ETS, and carbon leakage.

7. Annex

Source: QueSeas

See Also

Air Lubrication 101: A Comprehensive Introduction by QueSeas

Air lubrication system is an ever-growing technology for commercial shipping as a promising method to reduce ship hull resistance.