28 November 2024

What is Vessel Pooling? Avoid FuelEU 2025 Penalties

Vessel pooling can support your decarbonisation strategy and help you avoid FuelEU Maritime penalties through renewable and low-carbon fuels.

Table of Contents

Introduction – FuelEU Maritime

The FuelEU Maritime regulation entering into force in 2025 aims to reduce greenhouse gas emissions by promoting the use of renewable and low-carbon fuels by ships. Vessel Pooling is one way to avoid or minimise non-compliance penalties. But what is vessel pooling, how does it work and how can it help you avoid or minimise the cost of complying with FuelEU Maritime regulations?

In 2021, the European Commission adopted a series of legislative proposals known as the “Fit for 55” package to reduce greenhouse gas (GHG) emissions by 55% by 2030. The package includes four pieces of legislation that affect all vessels calling at an EU/EEA port. One of these is FuelEU Maritime and it is focused on promoting the use of renewable and low-carbon fuels that help to minimise carbon dioxide, methane and nitrous oxide emissions.

FuelEU Maritime aims to level the playing field between cheaper fossil fuels and more expensive low-carbon fuels. It does so by imposing penalties on ships that exceed the required GHG annual average intensity limits.

Because the carbon intensity of the vessel or fleet is measured as grammes of CO2-equivalent emissions per MJ of energy used, staying within the limits necessitates the use of alternative fuels or energy sources. Exceeding the limits will result in increasingly costly penalties. To avoid or minimise non-compliance penalties, owners can start using biofuel blends, convert a vessel to use low-carbon fuels, or join a pool of vessels verified by the same body in which one or more vessels already use such fuels.

Is Hydrogen Fuel Bad for the Environment?

Hydrogen fuel leaks are being investigated and labelled as the “new methane slip”, is this a fact or an excuse to continue the use of fossil fuels?

Ship Nerd

What is Vessel Pooling?

The idea of FuelEU Maritime is to stimulate investment in future fuel vessels and reward the use of alternative fuels such as green methanol and ammonia. For vessel owners, this means using a biofuel blend, retrofitting a vessel’s engines to run on more than one fuel or building a new multi-fuel-ready vessel.

The European Commission recognises the fact that the current supply of such fuels is not large enough for every vessel to operate on them. Therefore, to support the deployment of alternative fuel solutions, the legislation allows companies to pool the performances of different ships. This way the over-performance of one vessel can compensate for the under-performance of other vessels, provided that the total pooled compliance is positive.

For example, if a fleet of 21 vessels contains one running on green methanol, the 20 still running on traditional fuels could potentially use the positive compliance balance of the methanol-powered vessel to offset their own negative compliance balances.

How does Vessel Pooling actually work?

A company can register its intention to include a ship’s compliance balance in a pool in the FuelEU Maritime database. The pool can consist of two or more vessels from one or more companies, but one vessel may not be included in more than one pool in the same reporting period.

A pool is valid if the total pooled compliance is positive. This means that ships with a compliance deficit before joining the pool must not have a higher compliance deficit after the allocation of the pooled compliance. Similarly, any ship with a compliance surplus must not have a deficit after allocating its compliance balance to the pool.

Vessel Pooling is a smart and flexible way to start investing in alternative fuel-powered vessels that will soon become essential. Note that, Vessel Pooling has two main benefits: It reduces the amount of investment needed now, and it helps you generate savings to make future investments. Let’s look at these benefits in turn.

Vessel Pooling Benefit 1 – Reduce the Investment

Vessel Pooling reduces the investment needed now by increasing the time you have to make ultimately unavoidable investments. Rather than investing in an engine conversion for every single vessel in the pool, you can invest in one at a time and spread the benefits around multiple vessels while still achieving a positive calculation.

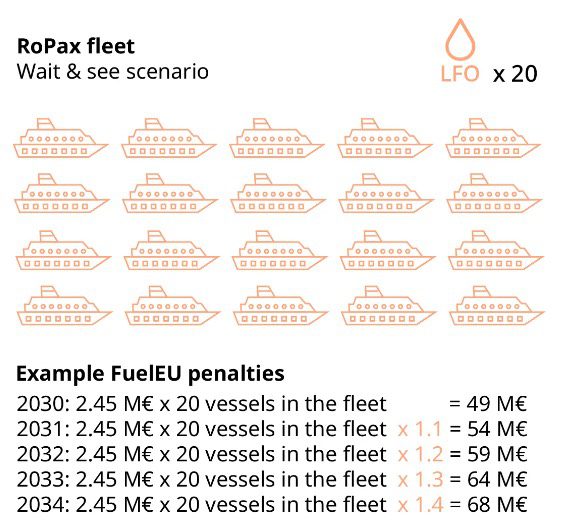

Let’s look at an example of this so-called ‘vessel pooling effect’ using a pool of 20 RoPax vessels running on very low sulphur fuel oil (VLSFO). As shown in the graphic below, when no action is taken, the rules allow a ‘multiplier’ to be used when calculating the remedial penalties for consecutive reporting periods.

Suppose a ship has a compliance deficit for two consecutive reporting periods or more. In that case, the penalty is multiplied by 1 + (n -1)/10, where n is the number of consecutive reporting periods for which the vessel operator is subject to a FuelEU penalty for the ship in question. Each year of incompliance adds another 10% points to the penalty. In other words, the more years you wait to take action, the more the penalties will increase.

However, as shown in the next graphic, when a vessel pooling approach is taken the result is very different.

- Add a single vessel running on eMethanol (a form of green methanol produced using green hydrogen) to the pool.

- This vessel generates enough greenhouse gas intensity (GHGIE) surplus every year to compensate for the deficit of the 20 ships that continue to run on VLSFO.

- You are not liable for any FuelEU Maritime penalties because the pool of vessels remains within the GHGIE limits.

- Your vessel running on eMethanol will help to reduce overall EU Emission Trading System (ETS) costs.

Vessel Pooling Benefit 2 – Generate Savings

Instead of paying heavy fines associated with non-compliance, you can use that money to make further investments and create a self-feeding positive cycle:

- Invest in one alternative fuel-ready vessel.

- Use the penalty savings to invest in a second alternative fuel-ready vessel or to upgrade some of your existing vessels with energy-saving technologies to save fuel.

- Use the savings to invest in another alternative fuel-ready vessel, upgrade another existing ship and so on.

How do I get started?

Deciding which vessels to invest in and in what order for optimal results depends on several complicated variables. You should unpick this puzzle, calculate the impact of the new regulations and choose the right solutions according to your operational profile and business case.

The consultative approach is broken down into three simple steps: analysis of the current state of your vessels, simulation to demonstrate the impact of potential investments and actionable data-based recommendations on which solutions are technically and economically viable.

Source: Wartsila

See Also

QueSeas has published an article focusing on the side effects of the inclusion of shipping in the EU Emissions Trading System (EU ETS).

The enforcement of the EU ETS may give industry stakeholders financial incentives to avoid voyages in the European Economic Area (EEA) and utilize neighboring non-EU countries as intermediate calls. This study investigates the carbon leakage possibility in the crude oil trade of the EU. Exploring three scenarios based on three common crude oil trading routes. Our results show that alternative pathways could lead to revenue loss for the EU ETS and increase the risk of carbon leakage.

A potential loophole in the EU ETS

Queseas has published an article focusing on the side effects of the inclusion of shipping in the EU Emissions Trading System (EU ETS).