28 November 2024

Methanol Production & Supply – Is it ready for full deployment in 2024?

The successful deployment of methanol as a marine fuel relies on renewable methanol production. Now, with more than 80 production projects the estimated production will exceed the 8m tons of renewable methanol per year by 2027.

Table of Contents

Renewables Supply

Successful deployment of methanol as a marine fuel relies on renewable production, from electrolysis and/or bioresources. More than 80 production projects are being tracked by the Methanol Institute with estimated production of more than 8m tons renewable methanol per year by 2027.

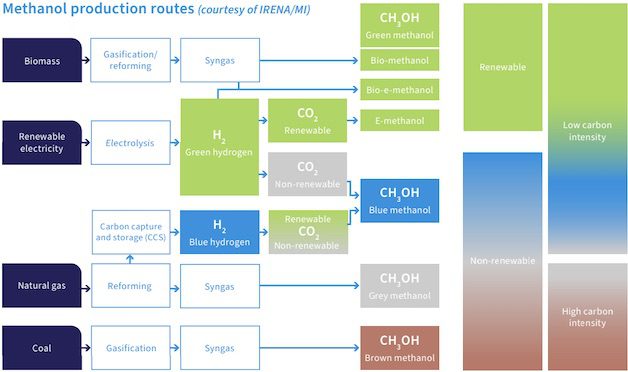

Much of the current methanol demand is met through the production of synthetic gases using coal or natural gas as a feedstock (brown and grey methanol). Depending on the pending decisions on CO2 life cycle accounting at an international level, the successful use of methanol as a marine fuel relies on the production of blue and green methanol in sufficient volumes and cost.

This chapter gives an overview of production methods and the expected future supply of blue and green methanol in

the coming years.

While standard methanol, biomethanol and e-methanol (brown, grey, blue and green) are chemically identical, their production pathways, and the verification of these pathways, will be the determining factor in acceptance as a net-zero

marine fuel.

Methanol Safety & Toxicity – General Issues

Methanol safety requires extreme attention with handling, considering its toxicity. This article provides fundamental insights and precautions for the fuel.

Ship Nerd

Additionally, shipping will compete with road transport and the chemical industry for green methanol as pressure mounts for all sectors to decarbonise. From this perspective, green and blue methanol price, the price of carbon and fuel availability will be the determining factors impacting fuel supply.

The life cycle emissions from current methanol production are 0.3 gigatons CO2 per annum. Over the last decade, production has nearly doubled – reaching 98m tons (there has been a large increase in China where production is from coal) in 2019. It is predicted to rise to 120m tons in 2025, before increasing to 500m tons per annum by 2050. 500m tons of methanol will therefore produce 1.5 gigatons of CO2 if production pathways do not move away from fossil fuels. Renewable methanol production in 2021 was only 0.2m tons.

Methanol Production

Current Industrial Production

On an industrial scale, methanol is predominantly produced today from natural gas by reforming the gas with steam and then converting and distilling the resulting synthesised gas mixture to create pure methanol. Current total methanol production, of all colours, is over 110 million tons a year, with the majority being used in chemical and petroleum industrial applications, as well as the production of consumer products. More on methanol production routes can be found on the Methanol Institute website.

Biomethanol Production

Biomethanol (green methanol) is produced by using biomass feedstocks (Forestry and agriculture waste and by-products, such as black liquor from the P&P (Pulp & Paper) industry, biogas from landfills, sewage and municipal solid waste). With low production volumes, the cost of production can only be estimated.

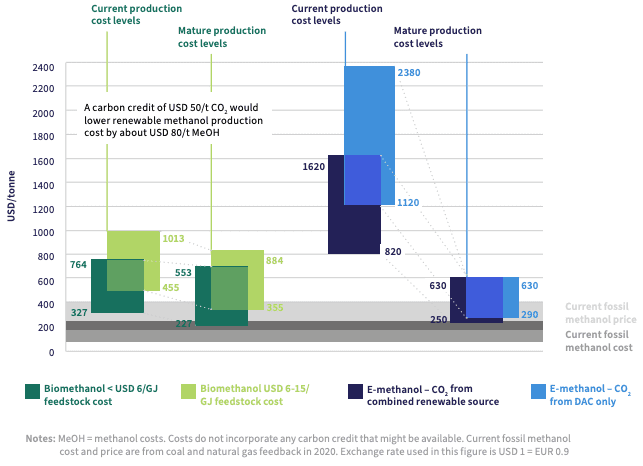

The cost of bio feedstock (biomass feedstock varies from 0 to $17 per gigajoule) investment costs and the efficiency of the conversion will play a role. An IRENA estimate in 2021 was for biomethanol to cost between $320 and $770 per ton, but process improvements could see this drop to a range of $220 to $560 per ton if the feedstock is under $6 per gigajoule (GJ).

Production of biomethanol when close to waste sources such as pulp and paper and Municipal Solid Waste (MSW) will help streamline production and improve overall economies of scale. Eventual bunker prices of biomethanol will depend on feedstock prices, the cost of hydrogen, and the cost of electricity. Additional capital costs for producers such as electrolysis and plant investments need to be considered as well as subsequent transportation costs.

E-methanol production

E-methanol (green or blue methanol) is obtained by combining captured CO2 with hydrogen from renewable electricity. The CO2 sources could be from industrial carbon capture including BECCS (bioenergy with carbon capture) and DAC (direct air capture). The hydrogen is produced through one of two ways, whether by using renewable electricity to electrolyte water into oxygen and hydrogen (green hydrogen) or through the reformation of natural gas, or coal, providing the CO2 emissions during this process are captured (blue hydrogen).

E-methanol costs will depend heavily on green electricity costs, hydrogen costs, infrastructure and capital investments. IRENA production cost estimates for e-methanol today are between $800 and $1600 assuming CO2 is from BECCS, with a cost of $10 to $50 per ton CO2 ($1200 to $2400 per ton methanol if the CO2 comes from DAC).

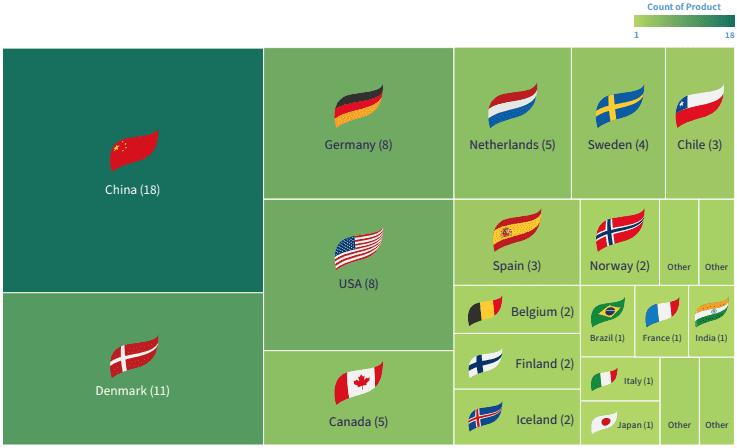

Projects by Country

The growing number of green methanol production projects around the globe can be seen on the Methanol Institute dashboard. The Institute is tracking 90 projects that are projected to produce almost 9m tons of methanol annually when online (by 2027). This production will not be dedicated to shipping use, but some projects are.

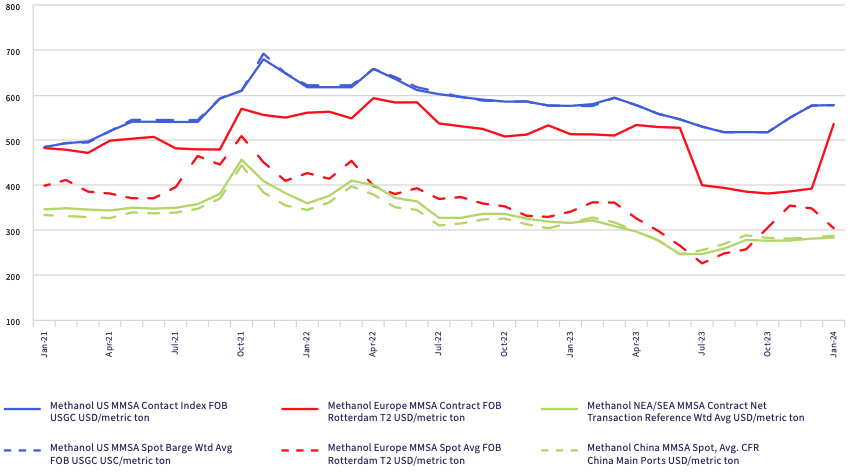

Fuel Price

Grey methanol prices vary regionally (Asia, USA and Europe) with spot market average prices and forward contracts (see table). Prices range from $327 to $366 per ton on-the-spot markets for February 2023. These prices are trading prices, and it is expected that green and blue methanol prices will be scarcer and more expensive. Additionally, bunkering infrastructure costs will create added expenses when cleaning methanol bunkers in ports and terminals. Estimates have pointed to green methanol being supplied initially at around $1,000 per ton.

Potential Trends

While HFO (very low sulphur fuel oil – VLSFO) is $600 a ton, marine gas oil (MGO) of same sulphur content is at approximately $876 per ton while intermediate fuel oil (IFO380) of high sulphur content is at $465 per ton When the different energy density between the fuels is considered, (for methanol x2.4) then the price of methanol as a marine fuel remains unfavourable without a price mechanism to encourage take up. Green methanol production costs remain uncertain. While the number of production plants under development grows, very few are currently in operation and producing significant volumes of methanol.

The adjacent table highlights the range of projections on production costs alone, making economic modelling for producers challenging. With grey and brown methanol users likely to also seek blue and green alternatives in the future, the market pressures on cost and availability will remain uncertain until some of these new renewable methanol projects are online.

See Also

Regulations require a change in the way that the marine industry operates. In the short term, efficiency improvements and energy-saving technologies can help. But in order to hit tough regulatory targets in the longer term, more operators are converting their vessels to run on lower carbon fuels.

But what’s needed to make the switch a success? We’ll look at five things to take into account with marine fuel conversion in this handy quick guide.

Marine Fuel Conversion – 5 Tips to Succeed

Regulations require a change in longer term and operators are turning to marine fuel conversion. But, what’s needed to make the switch a success?