28 November 2024

Green Steel assists the decarbonization for 2050

SSI published a report, addressing green steel which is critical to decarbonization across the shipping lifecycle considering that the steel industry is responsible for 7-9% of global GHG emissions.

Table of Contents

Concept

The Sustainable Shipping Initiative published the Green Steel and Shipping report. Steel is the primary shipbuilding material, making over 75% of a vessel by weight, and the steel industry is responsible for 7-9% of global GHG emissions. Addressing steel emissions is critical to decarbonizing across the shipping lifecycle and provides opportunities for collaboration with the steel sector and other steel demand sectors.

The research follows on from SSI’s 2021 Exploring Shipping’s transition to a circular industry report, which discussed the need to address circularity and lifecycle challenges ahead of the waterfall of vessels that will be recycled in the coming decades as the industry undergoes a decarbonization-driven shift.

Business as usual for decarbonization is not an option after 2023

BIMCO advises that 2023 will be defining for shipping’s decarbonization journey and the industry can no longer go about its business as usual.

Ship Nerd

Green Steel

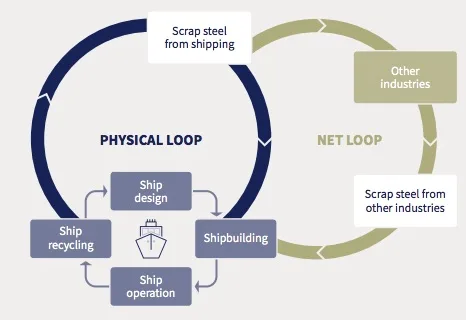

Current decarbonization efforts in shipping focus on and address emissions at the operational phase of a ship’s lifecycle. However, for shipping to decarbonize in a way that futureproofs the industry to 2050 and beyond, we need greater recognition of the emissions and sustainability aspects of the materials that make up a ship, as well as their lifespans, repairability, and re-use. The report focuses on steel as the primary material of a vessel and uses the following definition of green steel: “steel that is certified as meeting the highest levels of environmental, social and governance performance (ESG), rather than only addressing the release of greenhouse gases”.

Using green steel for shipbuilding is possible, and demand for this is starting to grow. SteelZero signatories, which include shipowner A.P. Moller-Maersk and CIMC TCREA (the steel buying division of container manufacturer CIMC) commit to using 50% lower embodied emissions steel by 2030.

The report identified drivers and barriers to closing the loop on steel in shipping, including the challenge of scrap steel supply, growing regulation around sustainability and emissions reporting, as well as the potential for tools, such as material passports, to enable demand and uptake of green steel in shipping. The need for traceability and transparency across the steel lifecycle was identified as a key lever to shore up demand for green steel in shipbuilding, creating a system that allows green steel users to prove its GHG emissions reductions and other sustainability credentials.

Quotes

“The shipping and steel sectors are interconnected and there are untapped opportunities for the two to work together to decarbonise sustainably. As a demand sector for green steel, shipping can support the steel sector’s decarbonisation journey while simultaneously addressing a source of its own scope 3 emissions. At the same time, the steel industry stands to benefit both from sustainable, zero emission maritime transport and from scrap steel sourced from end-of-life vessels. We hope that this report can build awareness and interest in the potential for green steel in shipping, in circularity, and the role shipping can play in enabling a sustainable, future-proof global system.”

Andreea Miu, Head of Decarbonisation, Sustainable Shipping Initiative

“Understanding the challenges and exploring viable solutions for reducing GHG emissions in the maritime sector is crucial. This report gives invaluable insights into the potential of green steel and highlights the necessity of adopting circular practices within our industry. A.P. Moller-Maersk, as a SteelZero member, committed to using 50% low emission steel by 2030 with the ultimate goal of utilizing 100% net zero steel by 2040. By equipping ourselves with knowledge on this subject, we can actively drive positive transformation and pave the way towards a sustainable future.”

Nicolò Aurisano, Sustainability & LCA specialist, A.P. Moller-Maersk

“Ensuring the availability of more sustainable materials in shipbuilding will play a key role in facilitating shipping’s energy transition. By embedding key circularity principles into the way design and build of ships are evaluated, and tracing the origin and type of materials during the construction, we have the opportunity to rethink material flows within a ship’s lifecycle and how they are inter-connected with other sectors. This enables us to collaborate with broader circularity efforts across the maritime value chain to achieve GHG reduction and decarbonisation targets for the industry.”

Amelia Hipwell, Decarbonisation Innovation Manager, Lloyd’s Register Maritime Decarbonisation Hub

“Beyond emissions from fuel use, another big step for the shipping industry, on its path to reduce their GHG emissions, is to focus on steel, the key material used for ships and containers. The global shipping industry must contribute to the demand for green steel. Secondly, it is essential that circularity should be the cornerstone of ship design.”

Kirsi Vuorinen, Project Manager, Steel Sector Decarbonization, WWF Finland

Source: SSI

See Also

South Korea shipbuilding had recently led the industry as their Chinese rivals grappled with COVID-19-related restrictions. However, they are facing growing challenges at the moment. Hence, the shipyards recently slipped back into second place for new orders. Now, despite a growing labor shortage, the government refused entry to welders recruited from Vietnam.

The Problems for South Korea Shipbuilding Industry

South Korean shipbuilders had led the industry but are facing growing challenges and recently slipped back into second place for new orders.