28 April 2024

Rapid adoption of green fuel cells in marine markets

IDTechEx released a report outlining the adoption of green fuel cells in marine markets, running on alternatives such as green hydrogen and ammonia, as some of the most promising solutions.

Concept

The maritime sector, which accounts for approximately 2.9% of global carbon emissions, is seeking to meet broader climate goals such as the Paris Agreement and ‘Fit for 55’ in Europe. Thus, IDTechEx said it sees green fuels, such as green hydrogen and ammonia, as some of the most promising solutions.

In its report ‘Fuel Cell Boats & Ships 2023-2033: PEMFC, SOFC, Hydrogen, Ammonia, LNG,’ IDTechEx has predicted that green hydrogen proton exchange membrane fuel cell (PEMFC) and LNG/green ammonia solid-oxide fuel cell (SOFC) markets will grow rapidly at 35% CAGR (compound annual growth rate) over a ten-year period.

The company explained that LNG vessels are the largest alternative fuel in marine markets. Noting that, the global LNG fleet has been growing for decades. It is driven by an initial policy aimed at reducing localized emissions (sulfur oxides, nitrous oxides, and particulate matter). However, the focus is now shifting toward reducing emissions of greenhouse gases, such as carbon dioxide and methane.

Witness to the shift are the new regulations in the maritime sector.

Regulations

The new International Maritime Organisation (IMO) policy includes an ‘Energy Efficiency Existing Ship Index (EEXI)’. Hence, ensures a ship is taking technical steps, in terms of equipment, to reduce greenhouse gas emissions. Moreover, the Carbon Intensity Indicator (CII), a measure of the carbon emissions per amount of cargo carried per mile, targets reducing emissions operationally.

MEPC 79 – New amendments & IMO GHG Strategy

What are the new amendments and GHG strategy that resulted from the IMO MEPC 79? This is everything you need to know.

Ship Nerd

IDTechEx said the new regulations undermine LNG use as a long-term solution because of methane slip. The slip occurs at every step in LNG’s lifecycle, alongside energy-intensive cooling (–161C) and re-gassing requirements. But, will create opportunities for alternative fuels, including green hydrogen, green ammonia, or e-fuels combined with carbon capture.

Marine Fuel Cells

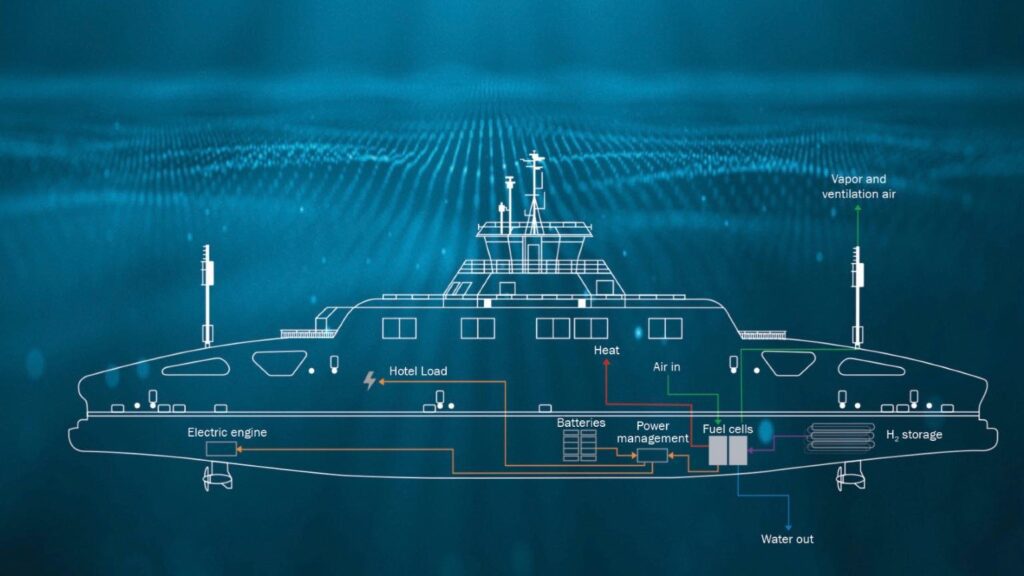

Currently, there are two main options for fuel cells in the marine environment. PEMFC, using green hydrogen, and SOFC, which are fuel flexible but notably can run on green ammonia, a derivative of green hydrogen.

Note that, PEMFC’s high-power density and ambient temperature operation make them suitable across various transport applications. Marine PEMFC suppliers include Nedstack, Powercell, and Ballard.

High-power marine fuel cell concept receives AiP

Ballard Power Systems and ABB receive approval in principle (“AiP”) from DNV for a jointly developed high-power marine fuel cell concept.

Ship Nerd

IDTechEx noted that, while none of the companies began supplying fuel cells to the marine sector, all have begun to pivot to the sector as opportunities pop up from regulations and funding.

Adding that innovations from those companies are also driving sales, with recent products greatly increasing power density and safety. Improvements include the use of novel stainless steel plate materials alongside double-walled hydrogen pipes, ventilation fans, and hydrogen sensors, allowing the fuel cell to position within the ship rather than on the open deck.

According to the project database tracked by IDTechEx in ‘Fuel Cell Boats & Ships 2023-2033: PEMFC, SOFC, Hydrogen, Ammonia, LNG,’ the average system size per vessel has now jumped to over 1 MW.

Applications

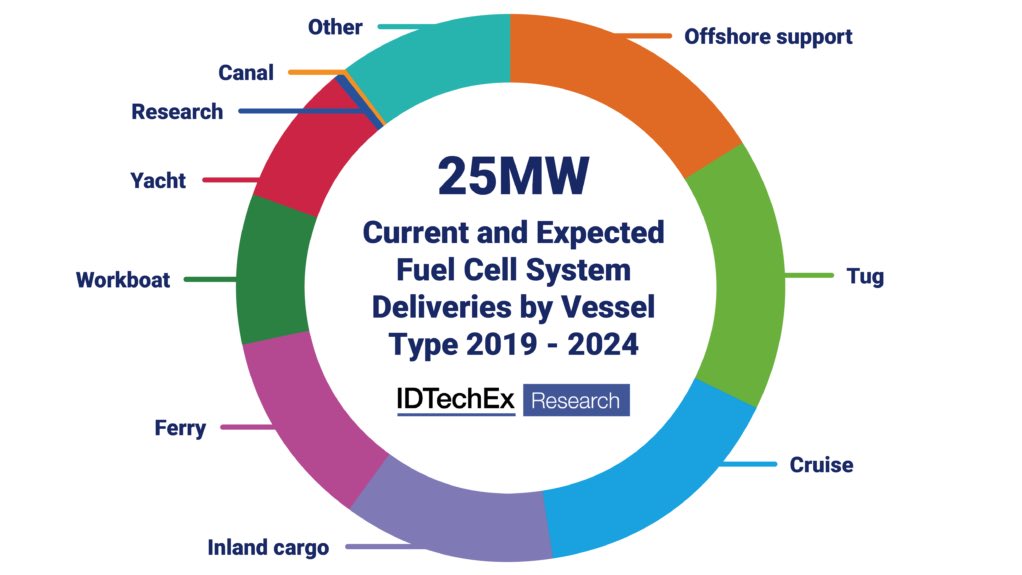

Currently, end-use is dominated by a few large systems in inland cargo vessels, workboats, offshore support vessels (OSVs), tugs, cruise ships, and ferries.

Marine fuel cell gets industry’s first type approval

Fuel cell supplier Ballard Power Systems has received type approval from classification society DNV for its marine fuel cell module FCwave.

Ship Nerd

Amongst the largest orders are a 3.2 MW PEMFC system from PowerCell, a 2 MW SOFC system from Alma Clean Power, and individual 2 MW PEMFC orders for the H-Tug and Ulstein OSV to be delivered by Nedstack.

IDTechEx concluded in expectations that for now most orders will use PEMFC technology and remain in inland and coastal sectors (due to the volumetric limits of hydrogen). However, it also predicts that repeat orders poise to drive rapid market growth.

Source: IDTechEx

See Also

Rightship’s maritime environmental predictions for 2023

RightShip’s team of sustainability and environmental experts give their predictions and ‘ones to watch’ for the maritime industry in 2023.