28 November 2024

Multi-fuel future with 3 or more types simultaneously

A survey suggests a multi-fuel future for the shipping industry on the path to zero emissions. As the global maritime industry embarks on a decarbonization journey, a recent survey conducted among industry stakeholders has revealed that the path towards decarbonization will be complex, with a wide range of fuels in the mix through 2050.

Table of Contents

Concept

To reach a zero-emissions future, the industry needs a more ambitious regulatory framework with clear reduction targets and supporting policies to close the cost gap between green fuels and the fossil fuels that currently power the global fleet.

Shipping companies—encouraged by regulation, customer demand, investor pressure, and internal goals—are searching for ways to find greener fuel alternatives and reduce greenhouse gas emissions by 2050.

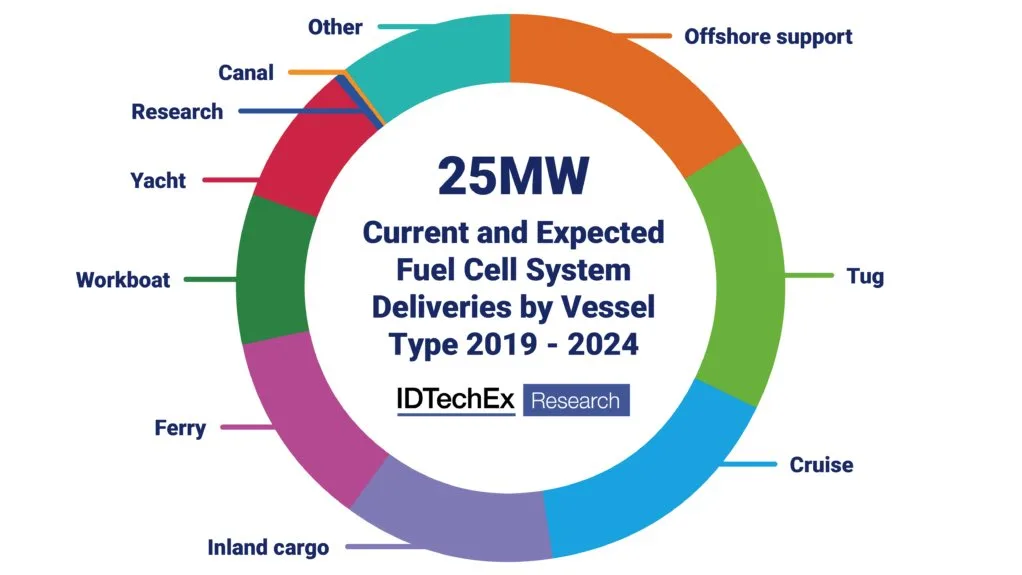

Rapid adoption of green fuel cells in marine markets

IDTechEx released a report outlining the adoption of green fuel cells in marine markets, running on alternatives such as green hydrogen and ammonia, as some of the most promising solutions.

Ship Nerd

To understand how shipping industry leaders are thinking about future fuels and what their plans and projections are to adopt cleaner fuels and efficiency-boosting technologies, the Global Maritime Forum, the Global Centre for Maritime Decarbonisation, and the Mærsk Mc Kinney Møller Center for Zero Carbon Shipping conducted a survey of major shipping companies, with analytical support by McKinsey & Company.

’’As the shipping industry is in a period of experimentation and exploration to understand the implications of adopting different green fuels, surveys like this play a crucial role to inform the industry and public, and support shipping’s transition to a zero-emissions future,’’

Professor Lynn Loo, CEO, Global Centre for Maritime Decarbonisation

Multi-Fuel Future

The most striking result from the survey is a multi-fuel future. Particularly, the need to prepare for fleets operating on 3 or more fuel ’’families.’’ The most common mix by 2050 represented by 45% of respondents is a fleet concurrently running vessels on fuel oil/biodiesel, methane, methanol, and ammonia—a step-change in fuel diversity.

“the industry will need to think strategically about how to operate multi-fuel fleets and green fuels must be introduced in a safe and cost-efficient manner to make them the preferred alternative to current petroleum products.’’

Bo Cerup-Simonsen, CEO, Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping

Other findings from the survey suggest that internal combustion engines will remain the preferred technology through 2050 and that the speed of the shipping industry’s adoption of alternative fuels will be a function of the cost gap with fossil fuels and the degree of availability of such greener alternatives at ports worldwide.

Ports and bunker suppliers might prioritize the availability of individual fuels in the short term. But in the longer-term, ports that wish to attract the greatest possible number of future vessels should prepare for the need to offer multiple fuel types.

Prime Drivers

The single most important factor in fuel choice will likely be the rate of decarbonization required by regulators. Policymakers and regulators can help close the cost gap between green fuels and fossil fuels and create a “level playing field” for all shipping companies to accelerate their adoption of green fuels.

’’To reach a zero-emissions future, the industry needs a more ambitious regulatory framework with clear reduction targets and supporting policies to close the cost gap between green fuels and the fossil fuels that currently power the global fleet. The sooner there is clarity about targets and policies, and the sooner these come into effect, the easier it will be for companies to develop a view on how to meet the goals. The role of regulators will be crucial in this process, in particular the outcome of the ongoing negotiations at the IMO,’’

Johannah Christensen, CEO, Global Maritime Forum

Conclusion

The companies surveyed roughly represent 20% of the world’s total fleet capacity; they own and operate container ships, tankers, dry bulkers, gas carriers, car carriers, cruise ships, tugs, and offshore vessels. The survey paints a multi-fuel picture of the industry that is striking. The onus is on each shipping company to develop its own proprietary view of its future fuel mix in line with its business strategy and decarbonization ambitions.

Access the survey here.

See Also

What is the safe operation of ships using biofuels and/or biofuel blends and how to comply with international regulations when using these fuels?

The use of biofuels or biofuel blends is one of many ways to comply with the IMO’s strategy on the reduction of GHG emissions from ships, and DNV has seen an increasing interest in these new fuels. Hence, we aim to clarify the regulatory status and other considerations regarding the usage of such fuels.

How to use the new biofuels in shipping

What is the safe operation of ships using biofuels and/or biofuel blends and how to comply with international regulations when using these fuels?